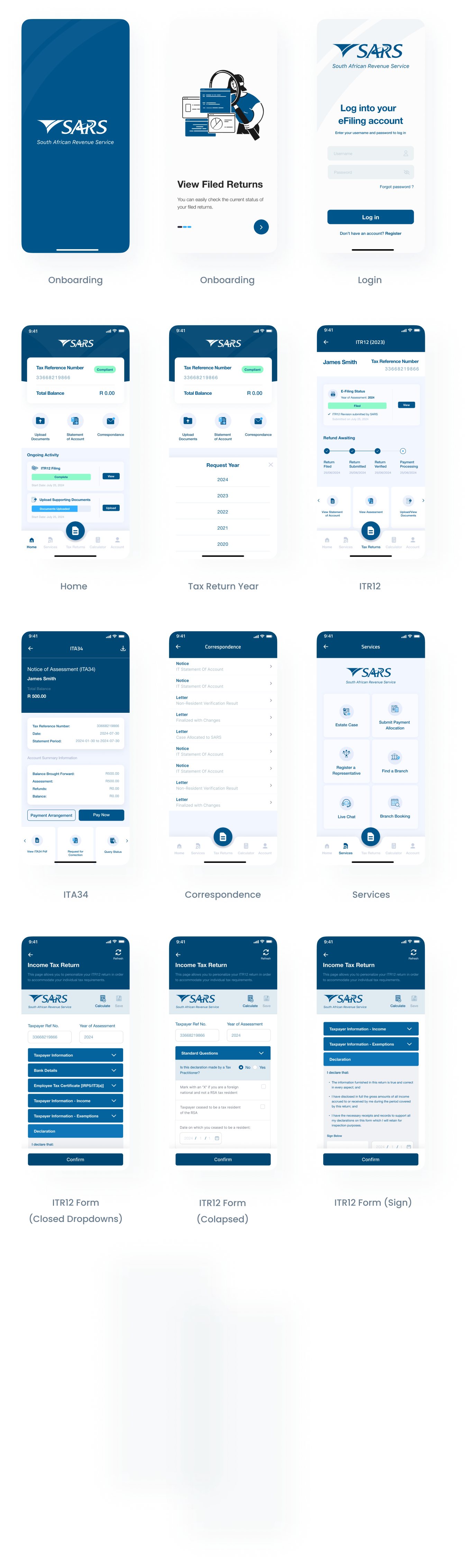

SARS e-Filing Case Study

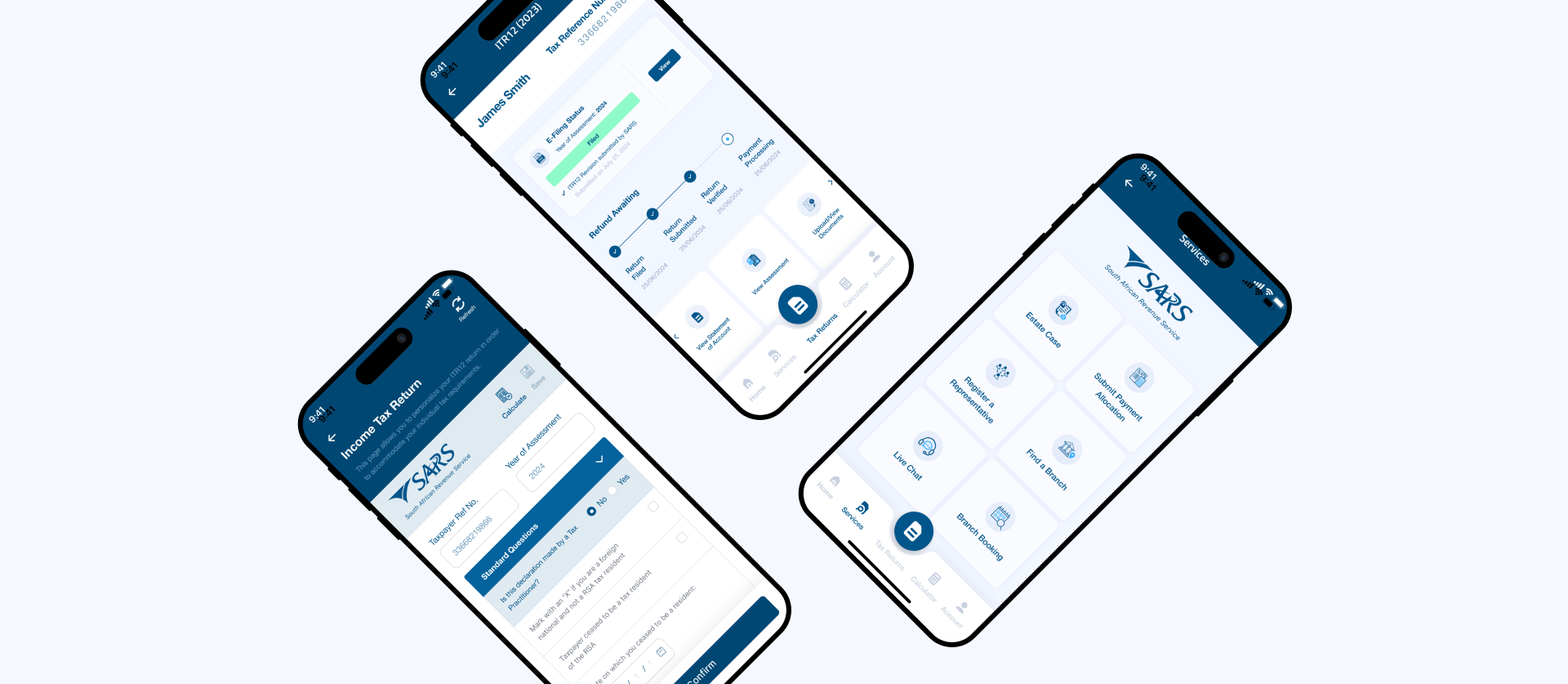

The South African Revenue Service (SARS) eFiling App allows taxpayers to submit their tax returns online.

Project Overview

This case study explores the user experience (UX) challenges within the app, identifies key pain points, and purposes design solutions aimed at improving usability and user satisfaction.

The Problem Statement

The SARS eFiling App currently presents significant usability challenges for users, particularly in the areas of navigation, accessibility, and information clarity. Users often struggle to complete their tax submissions efficiently due to a confusing interface, lack of intuitive design elements and insufficient guidance throughout the filing process. The leads to increased frustration, higher abandonment rates, and potential errors in tax submissions, ultimately impacting user satisfaction and compliance.

Project Goals

Simplify and StreamLine Navigation

Improve Accessibility

Facilitate Document Management

Business Challenges

User Adoption and Engagement:

- Challenge: Encourage taxpayers to adopt and regularly use the eFiling app.

- Impact: Low adoption rates can result in underutilization of the platform and continued reliance on manual or traditional filing methods.

Complexity of Tax Regulations:

- Challenge: Translating complex and frequently changing tax laws into a user-friendly digital interface.

- Impact: Users may find it difficult to understand and comply with tax regulations, leading to errors and increased support requests.

User Support and Education:

- Challenge: Providing adequate support and resources to help user navigate the app and understand their tax obligations.

- Impact: A lack of support can lead to user frustration, errors, and increased administrative burdens on SARS.

Mobile Experience:

- Challenge: Optimizing the app for mobile devices to cater to a growing number of mobile users.

- Impact: A subpar mobile experience can limit accessibility and deter users from using the app on their preferred devices.

Our Process

Quantitative & Qualitative Research

To better understand the users, we conducted Q/A sessions and surveys with 10 people who fall within out target group.

Observations

37% of the users found the app frustrating and rated the app 5 out of 10.

50% of the users earn between 237,101k – 370,500k Tax bracket.

87% of users used the SARS E-Filing app between 5-8 years.

75% of user found the app somewhat simple, but confusing to find what they were looking for.

75% of user found the app somewhat simple, but confusing to find what they were looking for.

In order to come up with solutions / features that will be helpful for users. We wanted to understand the overall tax data and see who are our biggest tax payers in terms of volume and which tax bracket they fall under.

To do this, we viewed the latest Tax report that SARS issued on their website.

We also viewed and recorded the complaints from the app stores.

After gathering insights, The following were identified in the 2022/23 fiscal year:

- Personal Income Tax (PIT) remains the largest contributor to tax revenue with contribution share of 35.7%

- The number of individuals registered for Income tax increased to 25.9 million in 2022/23 from 24.8 million in 2020/21, representing annual growth of 4.5%.

- The eFiling payments channel constitutes the majority of payments received by SARS are accounted for 77.9% of the total value of all taxpayer payments in 2022/23.

- There has been a growth in the use of electronic payment channels and in the decline in payments made at branch offices. The number of efiling payments in 2022/23 has increased to 56.1%.

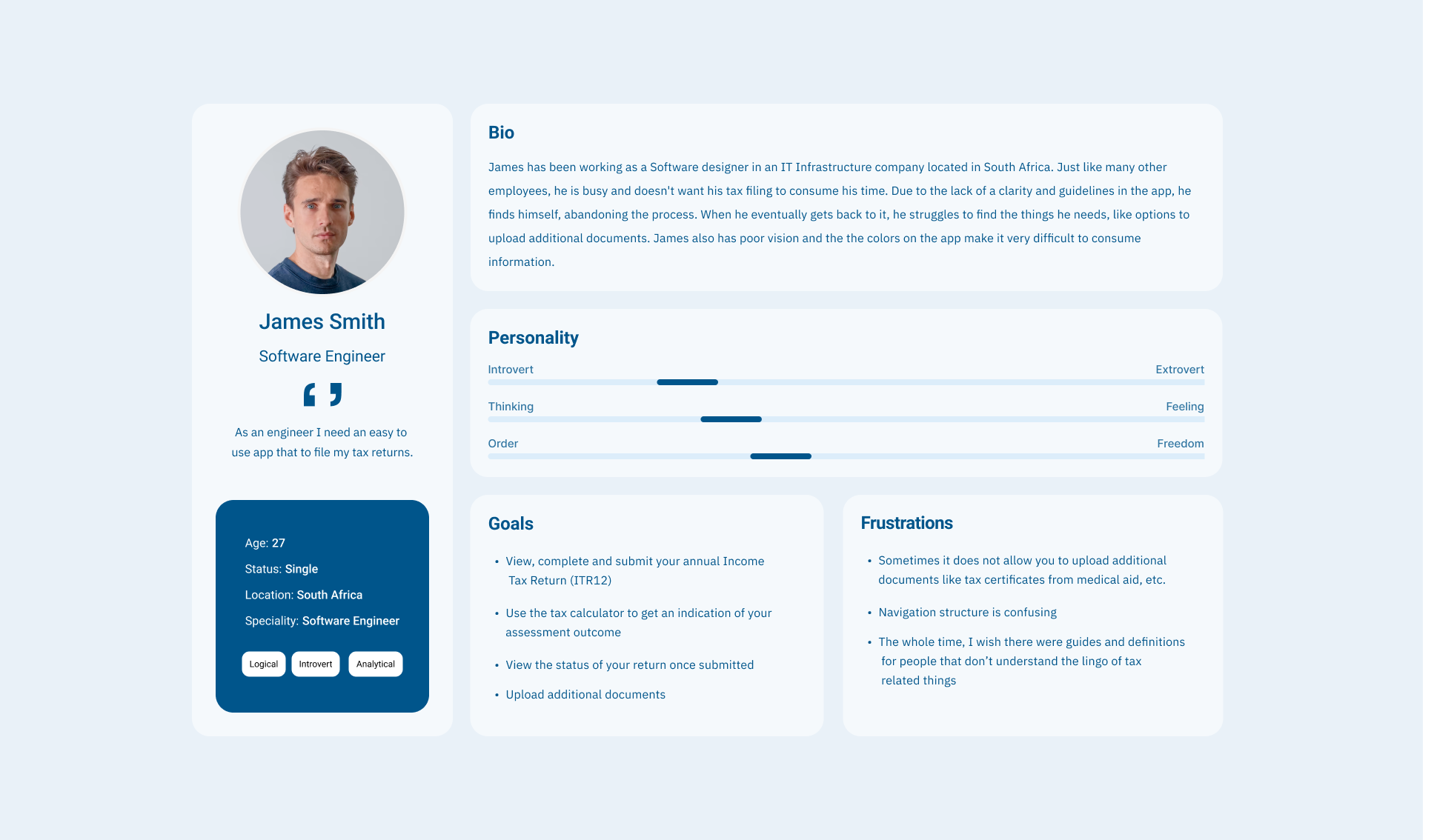

User Needs

Navigation

Users find it difficult to locate essential features and information quickly, resulting in a disjointed experience.

Accessibility Concerns

The app does not cater to users with varying levels of digital literacy.

Information Overload

Users are often overwhelmed by the amount of information presented, leading to confusion and potential errors in the filing process.

Feedback Mechanisms

Lack of timely feedback during the filing process can leave users uncertain about their progress and potential issues with their submissions.

User Persona

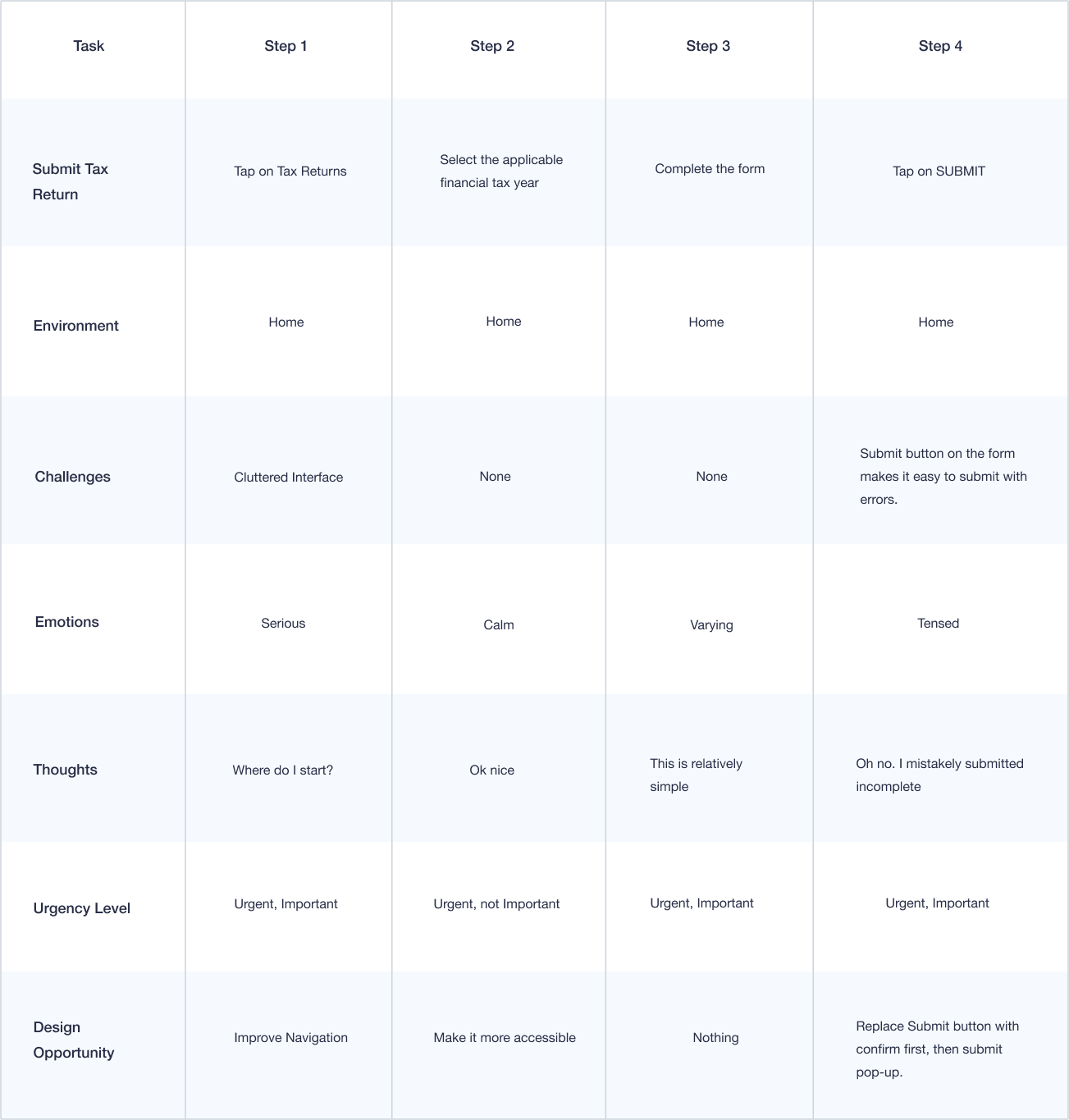

Task Mapping

The below shows the tasking mapping of filing the ITR12.

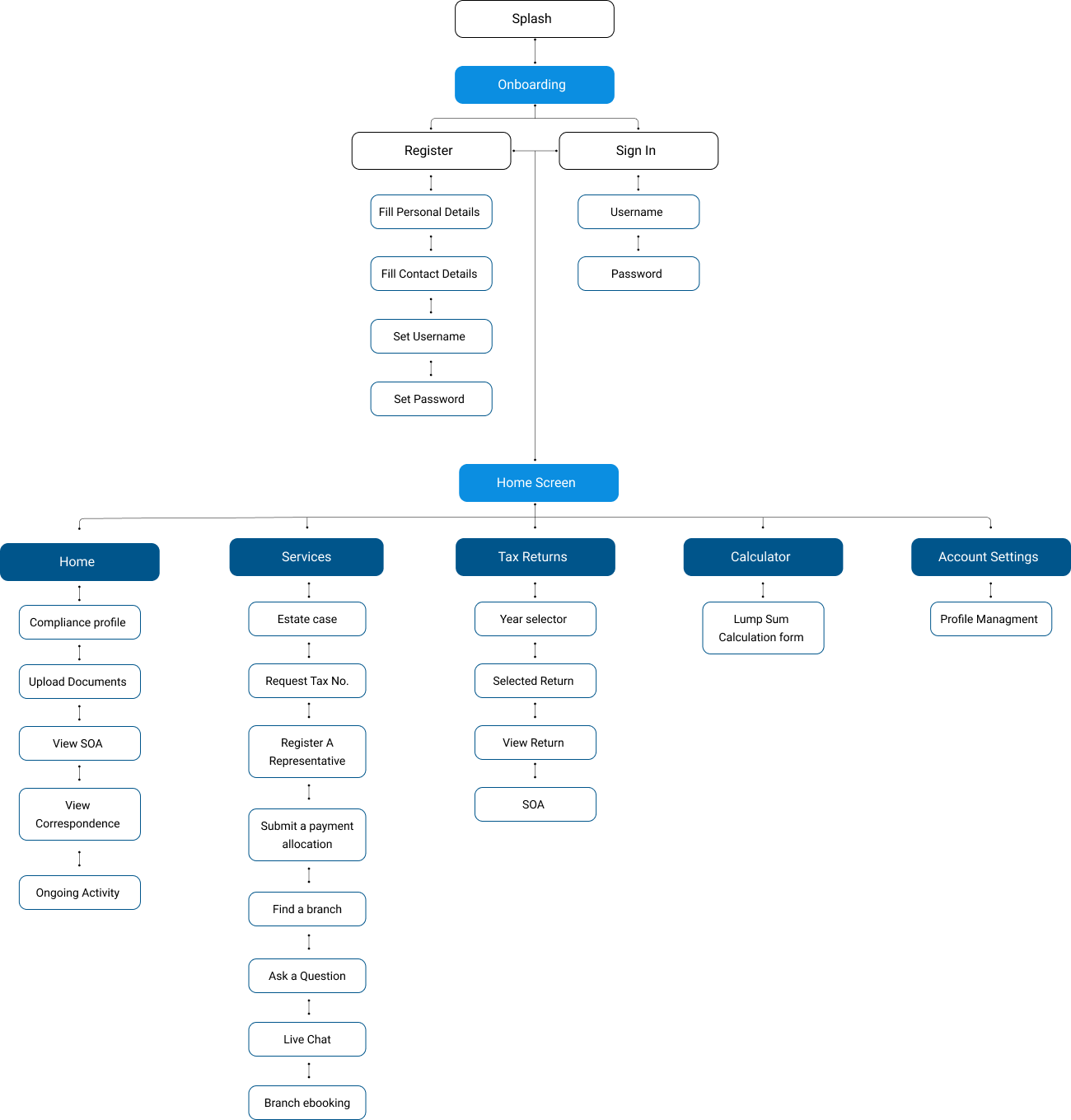

Information Architecture

Think of this as the structure of the contents in an application. How you present information/content matters, as it can make accomplishing a task a lot easier and friendly

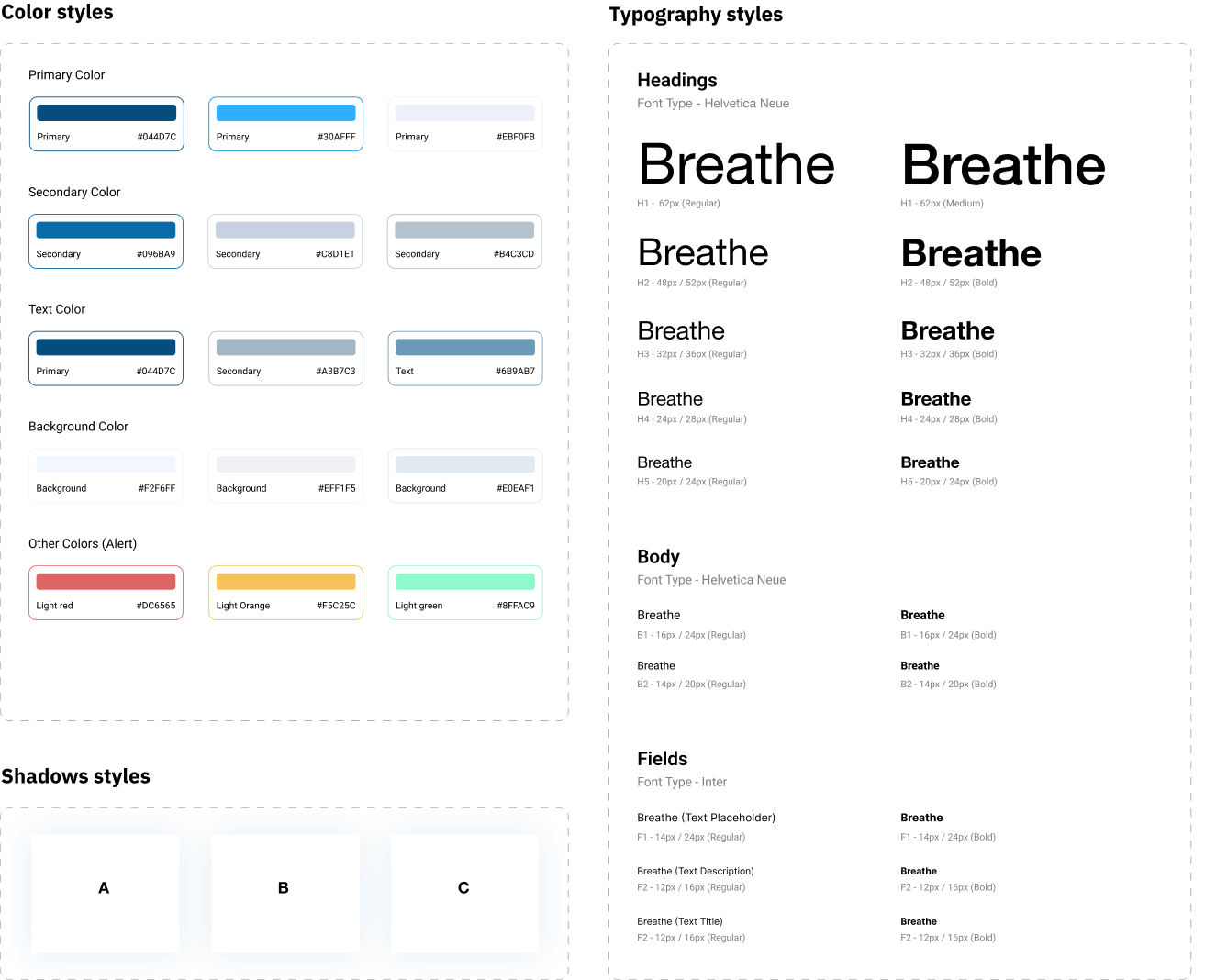

Style Guide

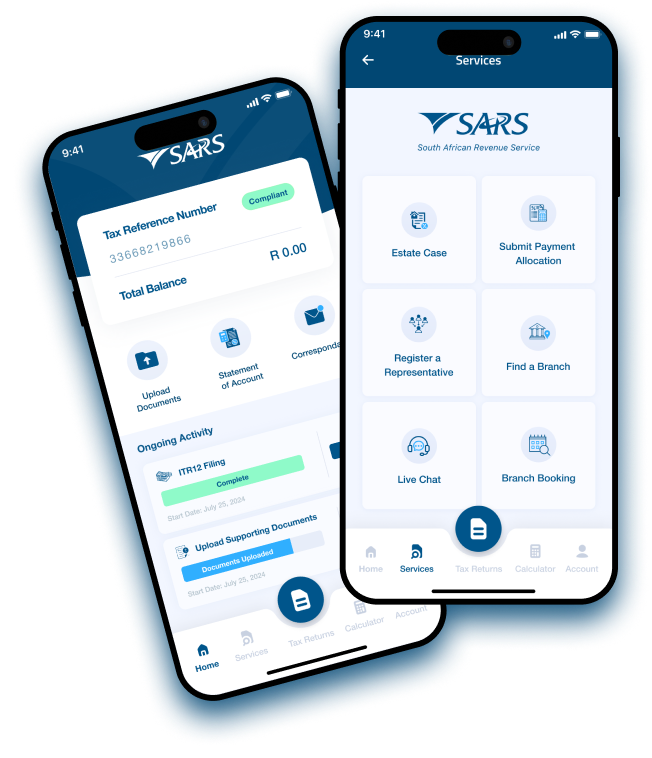

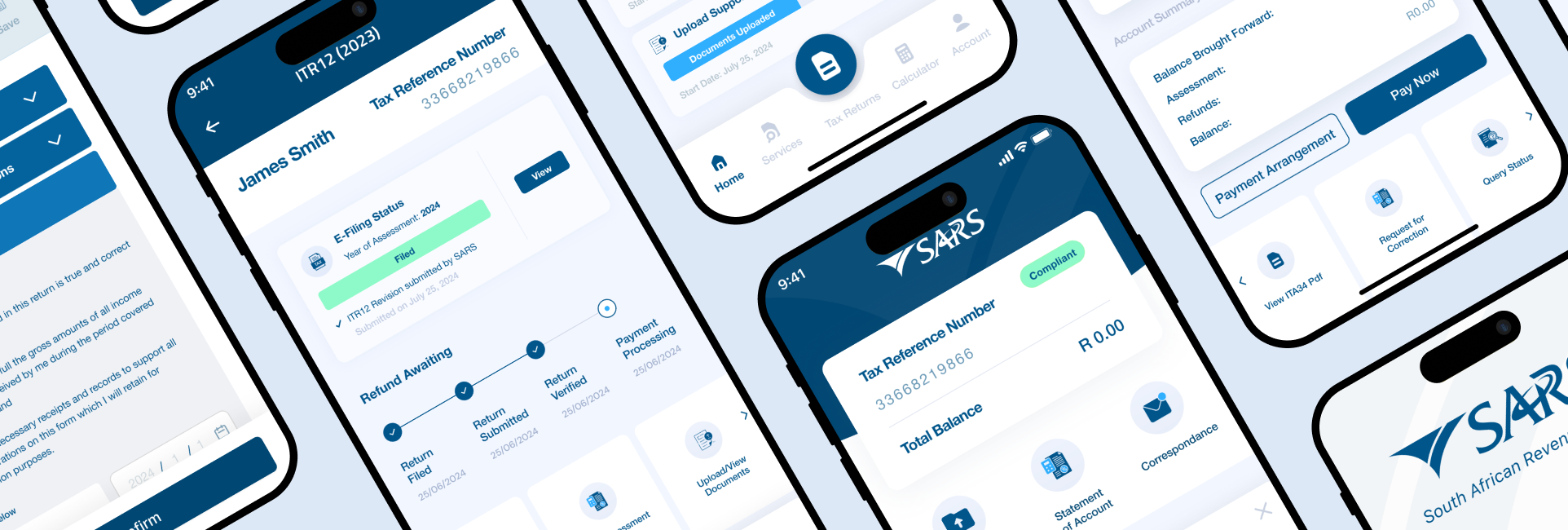

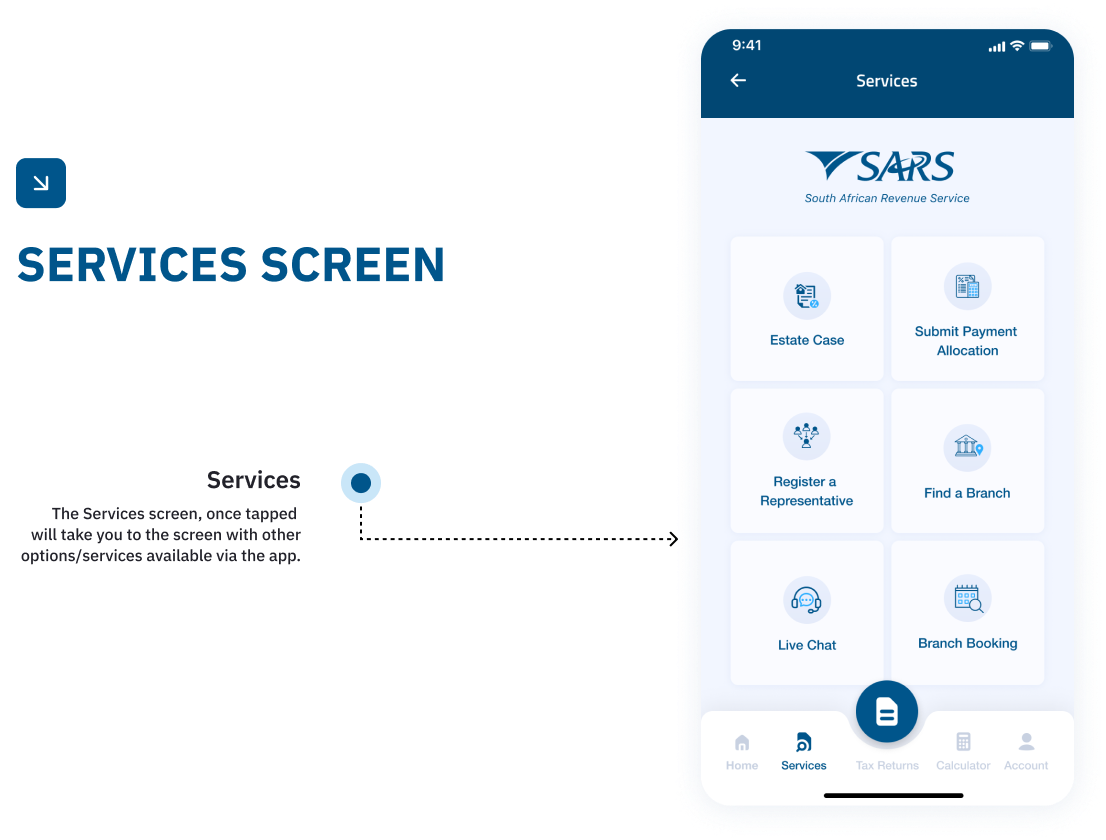

Solutions

Other screens